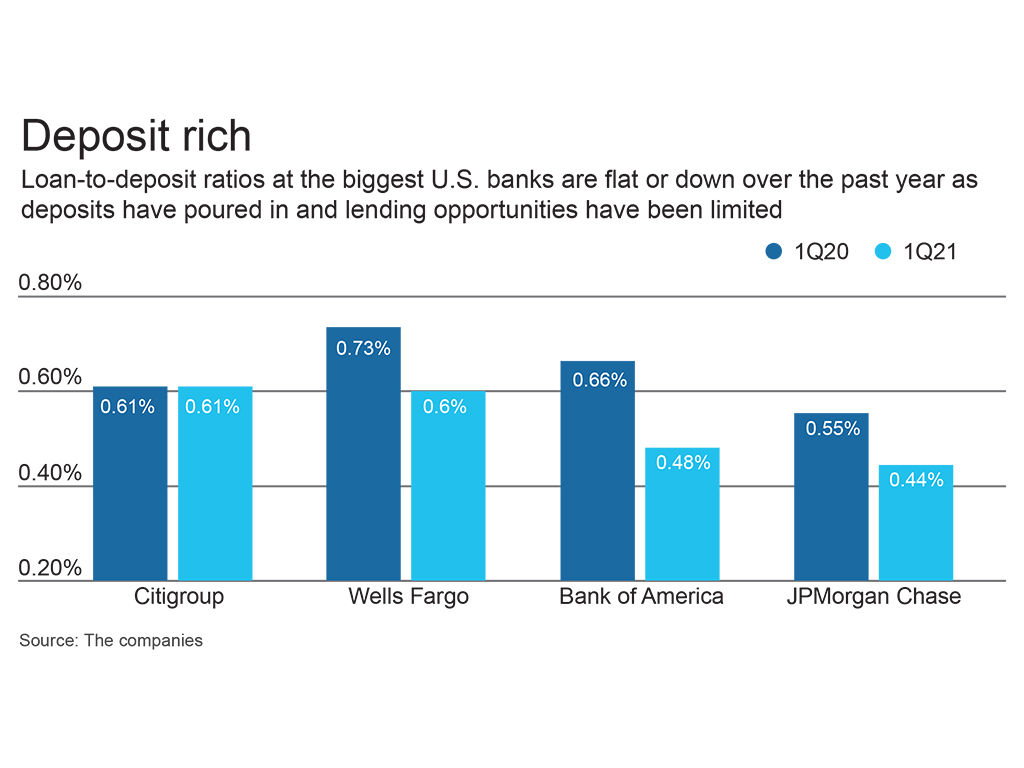

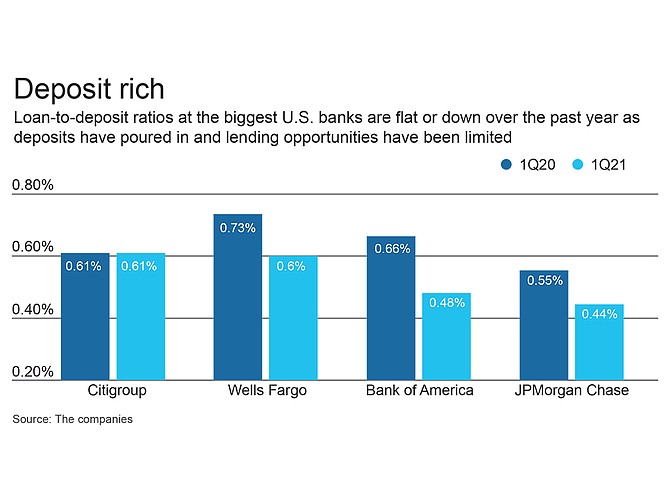

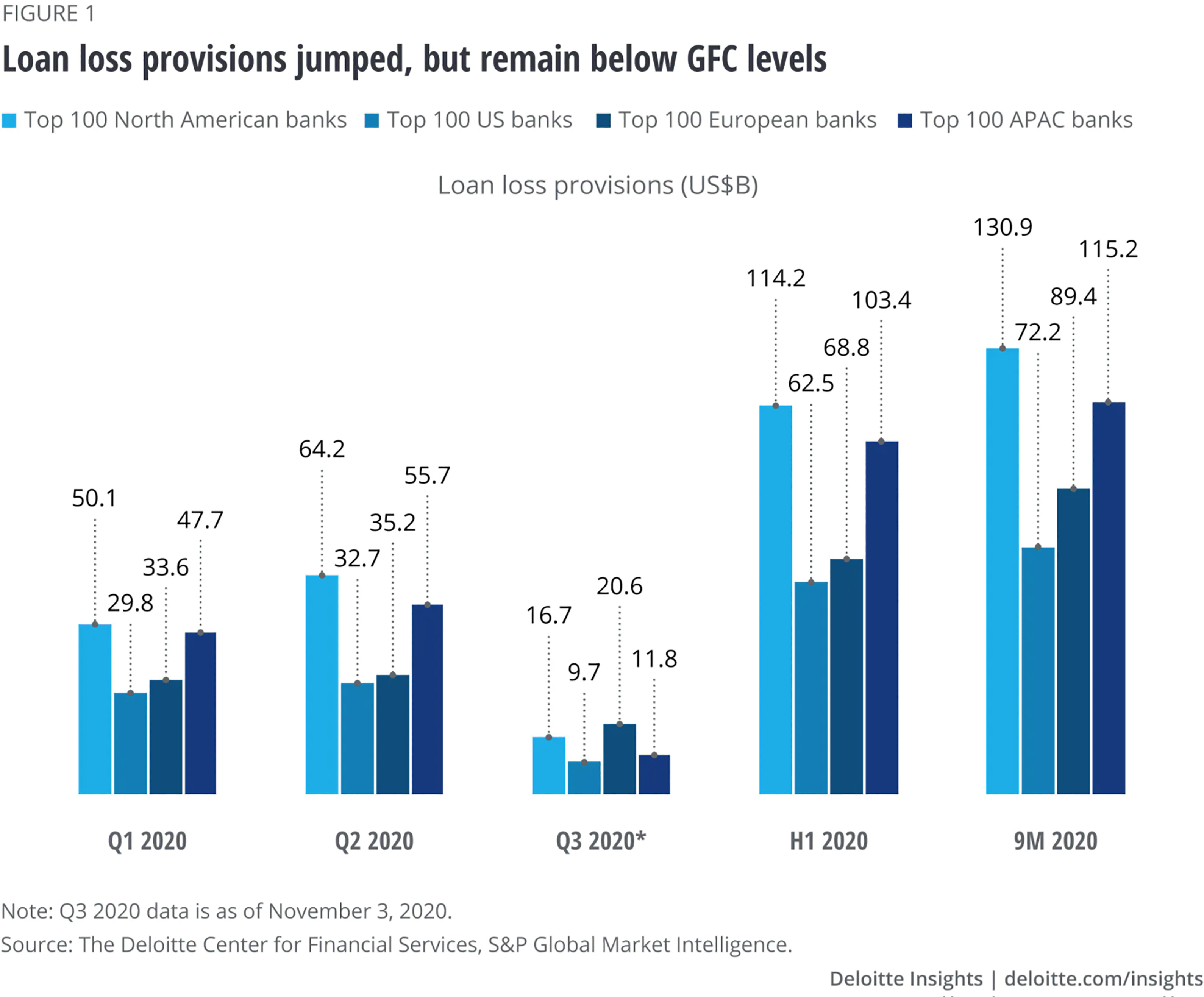

Chart courtesy of Deloitte.

In the first-quarter financial reports most banks showed record lending levels, all-time highs in deposits and saw loan growth.

However, due to extraordinary government stimulus and loan repayment holidays, those predictions did not materialize as San Diegans get back to business-as-usual. Today, banks are seeing a record surge in deposits and loan growth.

The San Diego Business Journal had a chance to discuss quarterly performance in the first half of 2021, deposit and loan growth, and top priorities for the remainder of this year with local financial leaders.

Strong Q2 Performance

Bank of America experienced significant overall growth in the second quarter. Total deposits reached a new record, with San Diego consumer deposits up an additional $3 billion from 2020. It also reported total loan growth for the first time since the pandemic began in the first quarter of 2020 while keeping credit losses at their lowest rates in 25 years.

Rick Bregman, president of Bank of America’s San Diego market, has credited much of that growth to historically low interest rates on mortgages during the pandemic.

“Our second-quarter results reflect increased client activity as the economy continued to reopen,” said Bregman. “Consumer spending has significantly surpassed pre-pandemic levels, and more face-to-face activity is helping to drive consumer products sales, household growth in wealth management and increased prospect calling in commercial banking.”

“We also received record level favorable feedback from San Diego clients, community partners and employees about how we helped each during the pandemic and now on the road to equitable recovery,” he said.

In the second quarter, Wells Fargo reported earning $6 billion and recorded total revenue of $20.3 billion, citing improved market conditions and strong credit quality for its strong quarterly results.

“The company’s results benefited from the continued economic recovery, strong markets that helped drive gains in our affiliated venture capital businesses, and our progress on improving efficiency, despite headwinds from low interest rates and tepid loan demand,” said Brian Lee, region bank president of Wells Fargo’s San Diego market.

“Credit quality continued to be exceptionally strong. Our results included a $1.6 billion pre-tax reduction in the allowance for credit losses, and charge-offs continued to decline. While we expect charge-offs will increase at some point, we continue to see strong trends in all of our businesses.”

Johnny Montes, is the regional director for consumer banking in San Diego at JPMorgan Chase, said the bank also saw significant growth in the second quarter.

Total debit and credit spend among consumers was up 45% year-on-year, up 22% versus the second quarter of 2019. Within consumer spending, travel and entertainment spending has really turned a corner up by 13% in June when compared to 2019,” he said.

During the second quarter, Pacific Premier Bank generated $1.58 billion in new loan commitments, an increase of 36.7% compared to the prior quarter, while loan fundings increased 54.5% resulting in annualized total loan growth of 14.5%.

“Our San Diego region has experienced growth in loan commitments that are on par with the Bank as a whole,” said Stephen Friedman, executive vice president and regional president for Pacific Premier Bank in San Diego.

“Our acquisition of Opus Bank in 2020 further expanded our presence and market position in San Diego and added additional banking talent that has strengthened our San Diego team. Pacific Premier Bank now ranks among the largest business banks in San Diego as measured by local deposits of close to $1 billion,” he said.

Growing Loans and Deposits

Chief Financial Officer Peter Conner of Banner Bank, said the bank saw $1.1 billion in core deposit growth over the first half of 2021, with a key focus on building client relationships. In addition, the firm originated $2.35 billion in loans in the first six months, which included especially robust core loan growth over the last quarter.

“We’ve built our bank to withstand all economic cycles because we understand our clients and the community are counting on us to be here, actively lending, regardless of where our nation is in an economic cycle,” said Conner. “That certainly remained true during the pandemic and it’s at the foundation of our growth and success you see in the numbers presented here.”

A.J. Moyer, president and chief executive officer at C3bank, said loan demand continues to be strong with high demand in both commercial and residential real estate.

“Many Businesses and Consumers have high amounts of liquidity driven from government stimulus, cash conversation or strong business results, which they have been utilizing in-part, to purchase real estate,” said Moyer. “In addition, high amounts of liquidity are driven from government stimulus, cash conversion or strong business results, which has been a strong driver of deposits across the banking sector.”

Similar to other banks, Tony DiVita, executive vice president of Bank of Southern California, said they experienced significant loan and deposit growth this year.

Bank of Southern California’s total loans increased to $1.4 billion, up 14.8% from the previous quarter and total deposits increased to $1.5 billion, up 21.6% from the previous quarter.

“While some of this growth can be attributed to our participation in the Paycheck Protection Program (PPP), our non-PPP loan portfolio had net organic growth of $76.2 million, related to new and existing relationships, which was fairly evenly divided between commercial and industrial loans, and commercial real estate loans,” said DiVita.

Significant Liquidity

Loan growth has been notably trending up from Q1 to Q2, said Kris Ilkov, corporate banking regional director of Umpqua Bank, adding that the firm expects to sustain the momentum into the second half of the year.

“Our efforts to support businesses through the worst of the disruption has also really positioned Umpqua as a strategic and trusted partner, especially as businesses have recovered from the COVID-19 impact and started to invest back into operations and product lines with increased confidence,” said Ilkov.

Steven Sefton, president of Endeavor Bank, said the firm outperformed expectations in every way including loans, deposits, earnings, capital, among other areas. Endeavor has seen four consecutive quarters of profitable operations, with assets reaching $500 million post-Paycheck Protection Program.

“We outpunched our weight in terms of the number and dollars of PPP loans we made,” said Sefton. “A strong client base, PPP loan growth and fee income, as well as a growing economy with great opportunity to help growing businesses with capital to invest, is a winning combination for Endeavor Bank.”

Omar Salah, head of small business at Union Bank, said the bank also saw an increase in deposits, which was driven by a number of factors including federal and state stimulus payments along with other pandemic-driven factors.

“We are seeing consumer spending approach near pre-pandemic levels. For example, our merchant card processing volumes have absolutely rebounded to pre-pandemic levels, which is a great sign for our small business community and the state of the economy,” said Salah.

“Additionally, small business loan volume is higher than it’s ever been, partially driven by the rate environment and the optimism we’re seeing in the small business community as we come out of the pandemic,” he said.

Keeping Momentum

Entering the second half of 2021, Bank of America’s Bregman said the consumer metrics the firm’s seeing today — deposit and loan growth in addition to an average of 20% more money in their accounts compared to even pre-pandemic levels — bode well for continued economic growth the remainder of this year and into 2022.

“Bank of America has recently opened four new financial centers across San Diego and are hiring substantially across business banking, commercial banking and wealth management in anticipation of continued responsible growth in the region,” said Bregman.

In July, Wells Fargo launched a new credit card portfolio, and with it a renewed focus on credit cards — and a new vision for new vision for growth for an important part of our consumer business.

“Our credit card business was ripe for reinvention. If you look at our range of offerings and standing across the industry, Wells Fargo is a “top 3” player in almost every significant product category — from debit cards to home mortgages, small business lending, and others,” said Well Fargo’s Lee.

“Looking ahead, we’re excited to also launch a new line of rewards cards in 2022. It truly is a new day at Wells Fargo, and we look forward to rolling out our new suite of consumer credit cards over the next year,” he said.

Bank of Southern California’s DiVita said, “As we look ahead, we remain focused on growth and expansion through building strong relationships. Many business segments are thriving and we believe the loan demand will continue in the foreseeable future.”

The bank recently announced the acquisition of Bank of Santa Clarita, which will provide the Bank with an expanded footprint that includes northern Los Angeles County, along with total assets of over $2.2 billion. “Many business segments are thriving and we believe the loan demand will continue in the foreseeable future,” he said.

Endeavor Bank’s Sefton expects clients to want more than loans and deposits from a bank, moving towards “consultative” banking.

“Clients want a partner to provide business advice to assist them with taking advantage of opportunities or overcoming challenges,” he said. “We call that consultative banking, or one good idea a year.”

Chart courtesy of Deloitte.

Chart courtesy of Deloitte.In 2020, the banking industry expected to see a decline in core business amid low interest rates and lack of loan growth. Those predictions did not materialize.