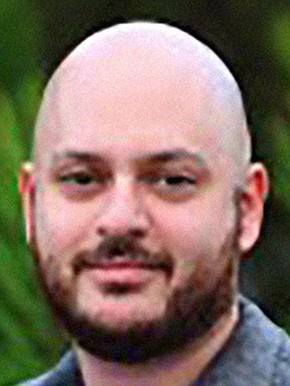

Photo courtesy of Qualcomm.

Qualcomm’s new CEO Cristiano Amon at the company’s San Diego headquarters.

Qualcomm’s multi-billion dollars in revenue in the third quarter, topped analysts’ average revenue estimate of $7.55 billion. Its stock is up more than 65% for the year.

Betting on 5G

Qualcomm is on pace to deliver $10 billion of annual revenues across RF front-end, IoT and automotive as it continues to diversify its business, said president and CEO Cristiano Amon.

“We are at the forefront of enabling this new ecosystem and also making 5G for industrial applications a reality,” said Amon. “We are becoming the connected intelligent edge partner of choice.”

Qualcomm recently launched an upgrade to its top tier processors for Android smartphones with the Snapdragon 888 Plus 5G. In the fall, the company expects the chips to show up in multiple markets.

The company also introduced new semiconductors and accelerator cards targeting small cells and infrastructure equipment, including technology to help in the industry transition to software-centric, virtualized radio access networks.

Anshel Sag, senior analyst at Moor Insights & Strategy said during the coronavirus pandemic, most semiconductor companies faced difficulty specifically within their supply chain, however he noted that Qualcomm seemed “less fazed,” by the downturn compared to its peers.

“Qualcomm’s quarterly success has come from capitalizing on a lot of major bets that they have made in the past few years,” said Sag. “If you look at all their business units, most of them did fairly well. It wasn’t just one standout division. Also, when you look at where those bets were placed — most of them were placed in 5G, which obviously paid off.”

Billion-Dollar Results

Qualcomm’s Amon, who took over on July 1, has prioritized the growth of the company’s RF front-end business, which gives the company an important component to sell to handset makers who may want to develop their own 5G modems.

“The need for our technologies and products has never been more evident,” said Amon. “We are seeing demand across virtually every industry because our products and technologies are essential ingredients that enable digital transformation in the cloud economy.”

Much of the growth was driven by chip sales. Qualcomm’s QCT semiconductor business reported $6.47 billion in revenue, a 70% increase annually. Handset chip sales made up the bulk of that business, though it was also the slowest growing component.

IoT revenues grew 83% year over year, to $1.4 billion, an increase of about $100 million over what the company had guided. RF front-end was the fastest-growing QCT segment, up 114% annually to $957 million in sales. RF front-end chips are an essential part of 5G.

Qualcomm’s IoT business, a part of QCT, which consists of low-powered chips to make other devices smart as well as networking and industrial uses, grew 83% to nearly $1.4 billion.

Looking Ahead

Qualcomm said for the full calendar year 2021, it is forecasting high single-digit growth for global 3G, 4G and 5G handsets, including 450 million to 550 million 5G handsets. For the fourth fiscal quarter, it’s forecasting revenues of $8.4 billion to $9.2 billion and earnings per share of $2.15 to $2.35.

The company expects the number of smartphones shipped by its customers to grow “high single digits” in 2021, after decreasing 11% last year during the pandemic, and between 450 million and 550 million 5G smartphones to be shipped this year.

Tantra Analyst Founder Prakash Sangam sees growing opportunity for Qualcomm specifically in verticals including, automotive, IoT, and VR — which has multi-billion annual opportunity for the global firm.

In addition, Sangam is tracking the adoption of millimeter waves, as network operators in Japan and South Korea are expected to roll out the technology soon. Verizon and AT&T already have deployed millimeter waves in parts of the U.S., which has been accelerating quickly.

“5G is on track and accelerating pretty quickly,” said Sangam. “Qualcomm’s adjacencies in automotive and IoT are also strong. They seem to have the right product mix to support the demand. As they continue to bring in new technology, it will be interesting to see how quickly their promise comes to a reality.”

Qualcomm Inc.

FOUNDED: 1985

CEO: Cristiano Amon

BUSINESS: Global semiconductor company

STOCK: QCOM on Nasdaq

REVENUE: $23.5 billion in 2020

HEADQUARTERS: Sorrento Valley

EMPLOYEES: 41,000

WEBSITE: www.qualcomm.com

NOTABLE: Qualcomm employs more than 41,000 employees globally, up from 37,000 in 2020.

CONTACT: Careers@Qualcomm.com